Your What is a golden cross in stocks images are available. What is a golden cross in stocks are a topic that is being searched for and liked by netizens now. You can Get the What is a golden cross in stocks files here. Download all free vectors.

If you’re searching for what is a golden cross in stocks images information connected with to the what is a golden cross in stocks topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

What Is A Golden Cross In Stocks. The original golden cross trading strategy has its origins in the stock market. A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. To understand the concept of a golden cross and trading golden cross stocks you first need to come to grips with the idea of moving averages. For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a.

Golden Cross Vs Death Cross What S The Difference From investopedia.com

Golden Cross Vs Death Cross What S The Difference From investopedia.com

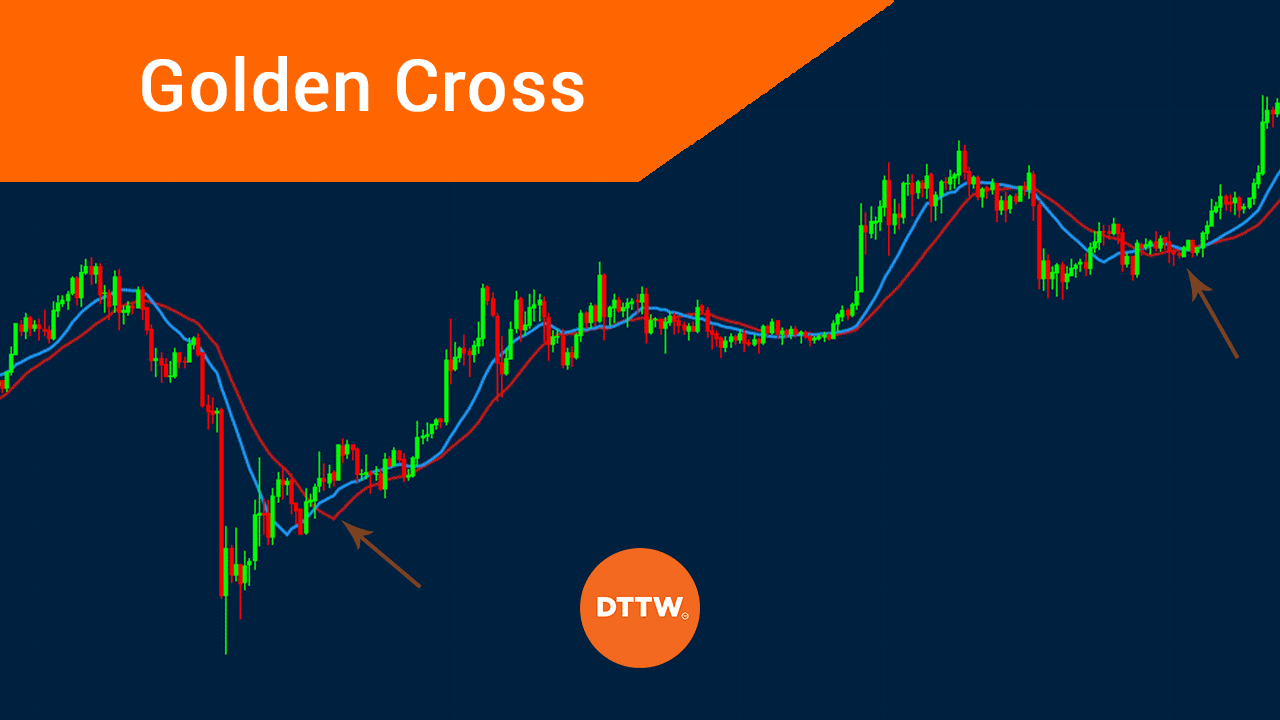

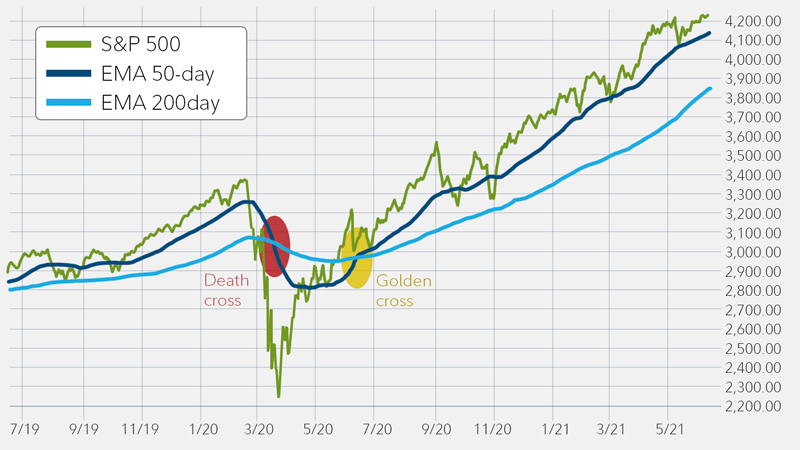

What is a golden cross. Golden Cross on a stock chart. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. Please select a date below. Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities.

Please select a date below.

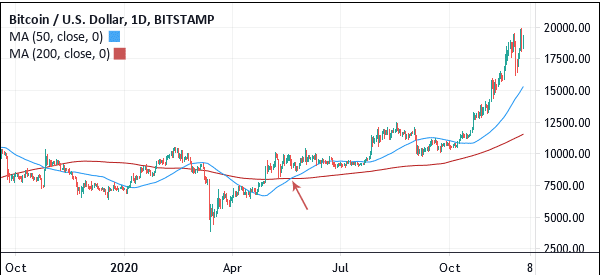

Golden Cross Chart Pattern. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. Therefore this shows that prices are gaining. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average. Is the Golden Cross still possible if the stock IPOd less than 200 days ago. It is a solid bullish price direction that works well with most crypto trading assets.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. When a stocks 50-day moving average crosses over its 200-day moving average it is known as a golden cross. This list is generated daily ranked based on market cap and limited to. In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3. Please select a date below.

Source: daytradetheworld.com

Source: daytradetheworld.com

Obviously the golden cross happens when the 50 day moving average crosses and exceeds the 200 day moving average. Specifically it is when a short-term moving average which reflects recent prices rises above a long-term moving average which is also the longer-term trend. To understand the concept of a golden cross and trading golden cross stocks you first need to come to grips with the idea of moving averages. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. This is because a longer time frame is usually predictive of a.

Source: tradingview.com

Source: tradingview.com

Please select a date below. It is a solid bullish price direction that works well with most crypto trading assets. Golden Cross Chart Pattern. Golden Cross on a stock chart. Track your portfolio and more.

Source: investopedia.com

Source: investopedia.com

This is often considered a bullish indicator or a buy signal. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. This is because a longer time frame is usually predictive of a. This is seen as bullish. For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a.

Source: stockmonitor.com

Source: stockmonitor.com

A golden cross is the crossing of two moving averages a technical pattern indicative of the likelihood for prices to take a bullish turn. What is a Golden Cross. Track your portfolio and more. On a stock chart the golden cross occurs when the 50-day MA rises sharply and crosses over the 200-day MA. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average.

Golden Cross Chart Pattern. Specifically it is when a short-term moving average which reflects recent prices rises above a long-term moving average which is also the longer-term trend. This is typically a telltale sign of bullish sentiment for a stock reinforced by high. Is the Golden Cross still possible if the stock IPOd less than 200 days ago. It is a solid bullish price direction that works well with most crypto trading assets.

Source: flowbank.com

Source: flowbank.com

Obviously the golden cross happens when the 50 day moving average crosses and exceeds the 200 day moving average. Please select a date below. Is the Golden Cross still possible if the stock IPOd less than 200 days ago. When a stocks 50-day moving average crosses over its 200-day moving average it is known as a golden cross. This is seen as bullish.

Source: investopedia.com

Source: investopedia.com

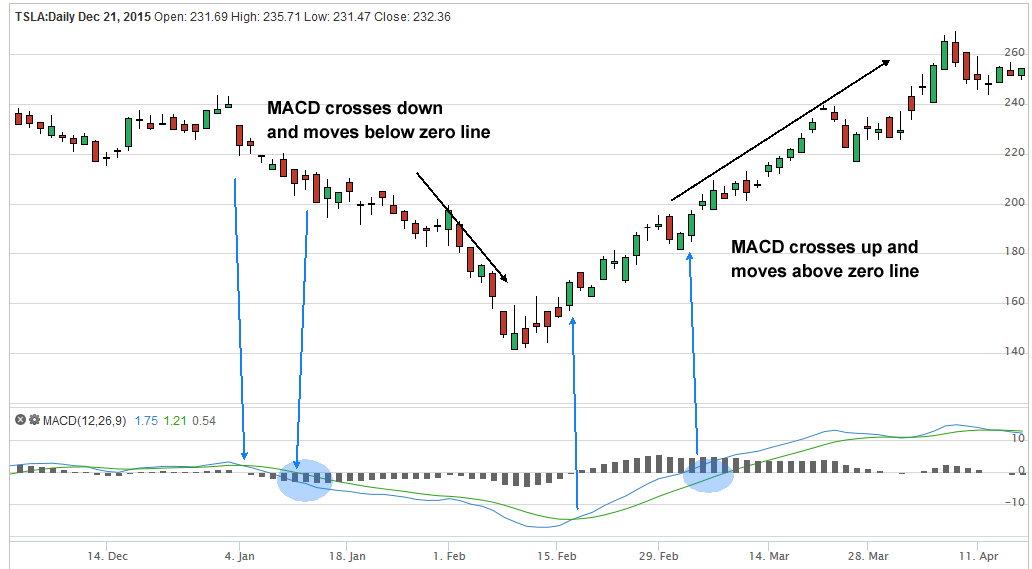

In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3. There are zero symbols here. A Golden Cross occurs when the 50-day crosses above the 200-day moving average and vice versa for a Death Cross Be careful of blindly trading the Golden Cross because the market can whipsaw you You can use the Golden Cross as a trend filter look to buy only when the 50-day is above the 200-day moving average. There are 0 symbols in this channel. The golden cross happened on February 12 2012.

Source: investopedia.com

Source: investopedia.com

When a stocks 50-day moving average crosses over its 200-day moving average it is known as a golden cross. This is probably a very dumb question but I cant seem to find an answer anywhere else. A golden cross happens when a short-term moving average crosses over a long-term moving average MA toward the upside. According to Joseph Granville a famous technician from the 1960s who set out 8 famous rules for trading the 200-day MA a golden cross can only occur when both the 50-day and 200-day moving averages are rising. A golden cross is the crossing of two moving averages a technical pattern indicative of the likelihood for prices to take a bullish turn.

Source: speedtrader.com

Source: speedtrader.com

A Golden Cross is a basic technical indicator that occurs in the market when a short-term moving average 50-day of an asset rises above a long-term moving average 200-day. A Golden Cross is when a stocks 50 day moving average crosses above the 200 day moving average. When traders see a Golden Cross occur they view this chart pattern as indicative of a strong bull market. It is a solid bullish price direction that works well with most crypto trading assets. A golden cross is a technical pattern that occurs when a securitys short-term moving average crosses above its long-term moving average.

Source: makemoneyyourway.com

Source: makemoneyyourway.com

Therefore this shows that prices are gaining. This is often considered a bullish indicator or a buy signal. To understand the concept of a golden cross and trading golden cross stocks you first need to come to grips with the idea of moving averages. Obviously the golden cross happens when the 50 day moving average crosses and exceeds the 200 day moving average. The golden cross pattern is when a short-term moving average pattern crosses above a long-term moving average.

Source: tradingsim.com

Source: tradingsim.com

The Golden Cross To find a golden cross technical analysts plot two moving averages of a stock or other assets price – a short-term average and a long-term average. The golden cross stock pattern is a pattern that can point to a possible upswing in the market. This is seen as bullish. The original golden cross trading strategy has its origins in the stock market. The golden cross happened on February 12 2012.

Source: fidelity.com

Source: fidelity.com

When a stocks 50-day moving average crosses over its 200-day moving average it is known as a golden cross. Please select a date below. Is the Golden Cross still possible if the stock IPOd less than 200 days ago. Summary - A golden cross is a technical indicator that is always a predictor of a bullish trend for stocks and other securities. In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3.

Source: tradingindepth.com

Source: tradingindepth.com

The Golden Cross To find a golden cross technical analysts plot two moving averages of a stock or other assets price – a short-term average and a long-term average. This is because a longer time frame is usually predictive of a. In their most basic form a moving average takes the closing price of a stock from each of the previous days over a given period- lets say 50 days and then divided. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. A Golden Cross occurs when the 50-day crosses above the 200-day moving average and vice versa for a Death Cross Be careful of blindly trading the Golden Cross because the market can whipsaw you You can use the Golden Cross as a trend filter look to buy only when the 50-day is above the 200-day moving average.

Source: tradingview.com

Source: tradingview.com

Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. Golden Cross The golden cross occurs when a short-term moving average crosses over a major long-term moving average to the upside and. This is because a longer time frame is usually predictive of a. In their most basic form a moving average takes the closing price of a stock from each of the previous days over a given period- lets say 50 days and then divided. In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing.

Source: speedtrader.com

Source: speedtrader.com

101 rows Golden Cross- SMA 50 Crossing above SMA 200 - Technical Screener. There are zero symbols here. Unlike death crosses golden cross stocks occur when the 50-day MVA of a stock crosses above the 200-day MVA. This is often considered a bullish indicator or a buy signal. Even better the second golden cross pays off as the foreign exchange rate rises to top off at a high of 14889 over 100 pips above the support level.

Source: daytradetheworld.com

Source: daytradetheworld.com

It is a solid bullish price direction that works well with most crypto trading assets. The golden cross happened on February 12 2012. Golden Cross on a stock chart. This is because a longer time frame is usually predictive of a. A golden cross forms when a short term moving average crosses over a longer-term moving average.

Source: speedtrader.com

Source: speedtrader.com

In late 2012early 2013 there was another very brief death cross that happened but had you sold stocks at that point you would have missed out on a phenomenal rally that began almost immediately in early 2013 when the Fed began QE3. For a recently IPOd stock which only has a 50 day moving average is it even possible to predict a. 101 rows Golden Cross- SMA 50 Crossing above SMA 200 - Technical Screener. In contrast to the cross of death the golden cross is a strongly positive market indicator indicating the beginning of a long-term upswing. The Golden Cross is a bullish chart pattern used in technical analysis that is to help predict future price movement.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a golden cross in stocks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.